Short bio

I am a lecturer at the Institute of Economic Studies, Charles University (IES FSV UK). I have completed my Ph.D. research under the supervision of doc. PhDr. Jozef Baruník, Ph.D. Simultaneously, I am a researcher at Institute of Information Theory and Automation at the Czech Academy of Sciences (ÚTIA).

I concentrate my research on the field of financial econometrics. Specifically, I am interested in asset pricing, effects of various sources of risks with heterogeneous persistence, connectedness on financial markets, and time-variability of asset pricing relationships. My other research interest is predicting the outcomes of sporting events.

Research Interests

- Asset pricing: heterogeneously persistent risks, time-varying predictability, higher moment risks

- Other interests: predicting sport outcomes, betting strategies, connectedness

News

-

[October 2025] Defended dissertation thesis “Essays on Financial Market Asymmetries”

-

[April 2025] Passed pre-defense of the Dissertation thesis titled “Essays on Financial Market Asymmetries”

-

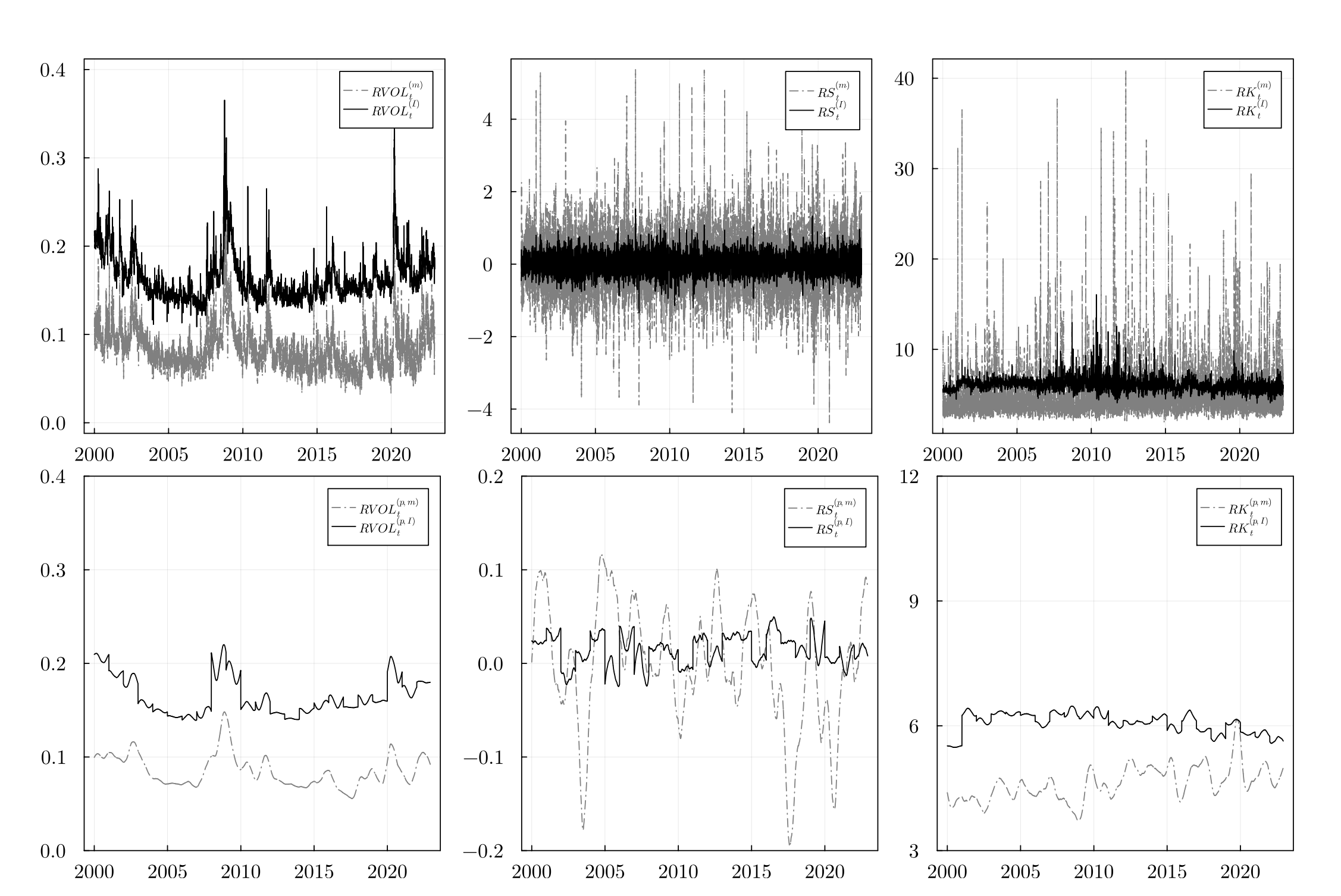

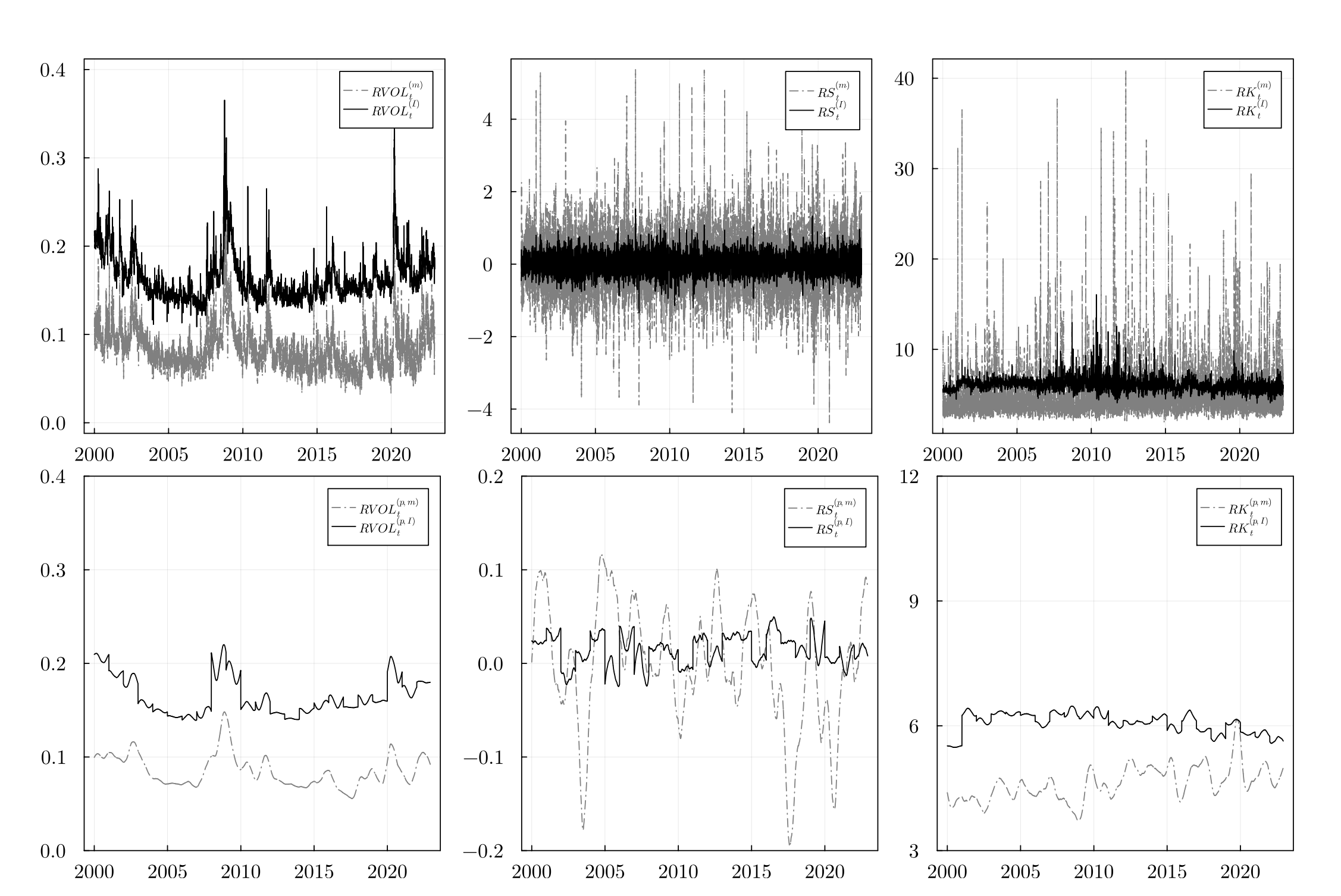

[November 2024] “Risks of heterogeneously persistent higher moments” (with J. Baruník) published in International Review of Financial Analysis

-

[May 2024] Submitted revision of “Heterogeneously Persistent Higher

Moments Risks” (with J. Baruník)

In progress

- Skewness Dispersion and the Expected Equity Premium (with M. Babiak and J. Baruník)

Publications

-

IRFA

IRFA

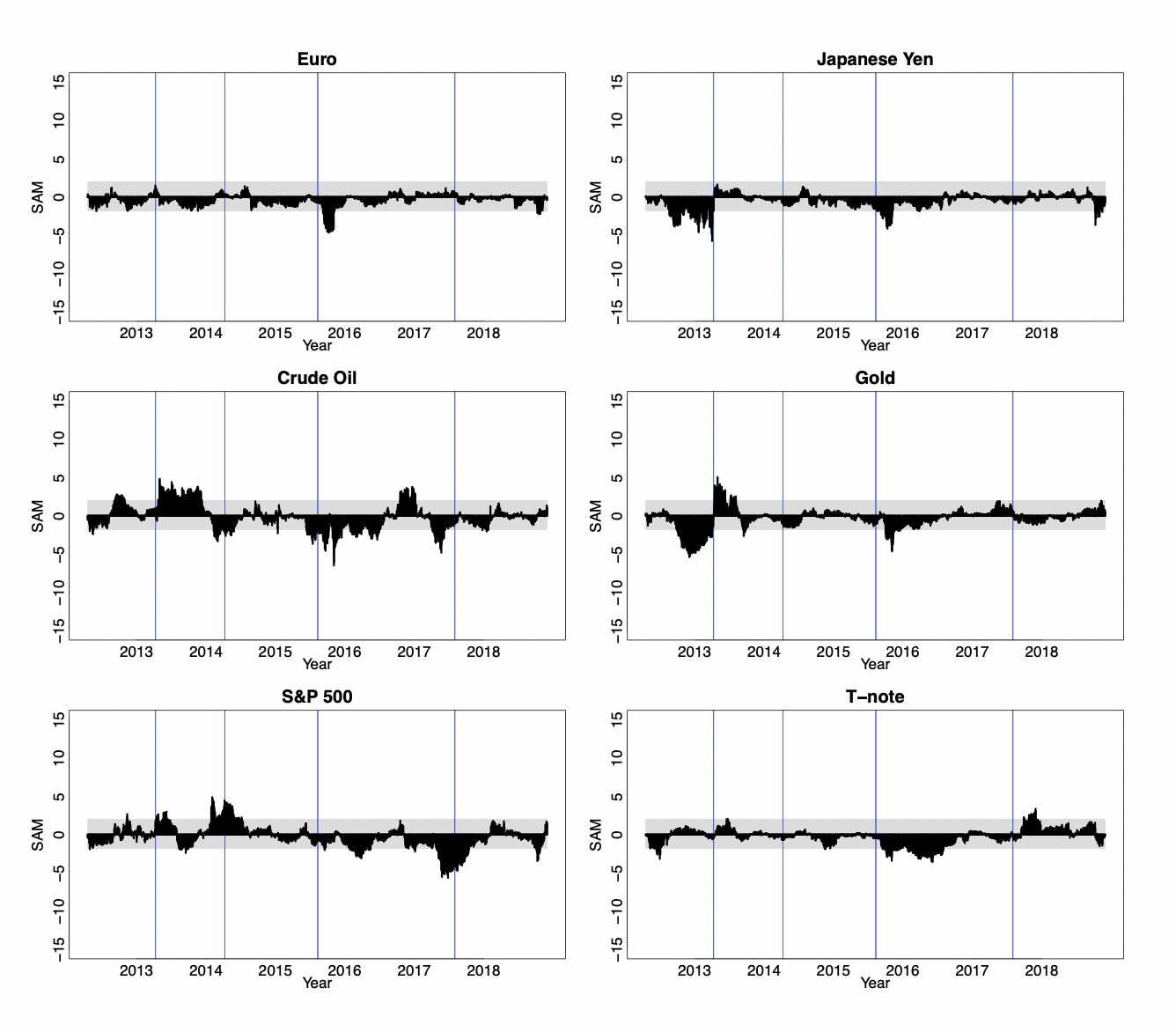

Jozef Baruník, Josef Kurka*

International Review of Financial Analysis, 96, 103573, 2024

-

FRL

FRL

Josef Kurka

Finance Research Letters, 31, 38-46, 2019

Conferences

Selected conferences

-

06/2025: · 6th International Workshop on Financial Markets and Nonlinear Dynamics (FMND), Paris· “Beyond the Mean: Cross-Sectional Skewness Dispersion and Expected Equity Returns”

-

10/2023: · Statistics of Machine Learning (Stat of ML), Prague · “Heterogeneously Persistent Higher Moment Risks.”

-

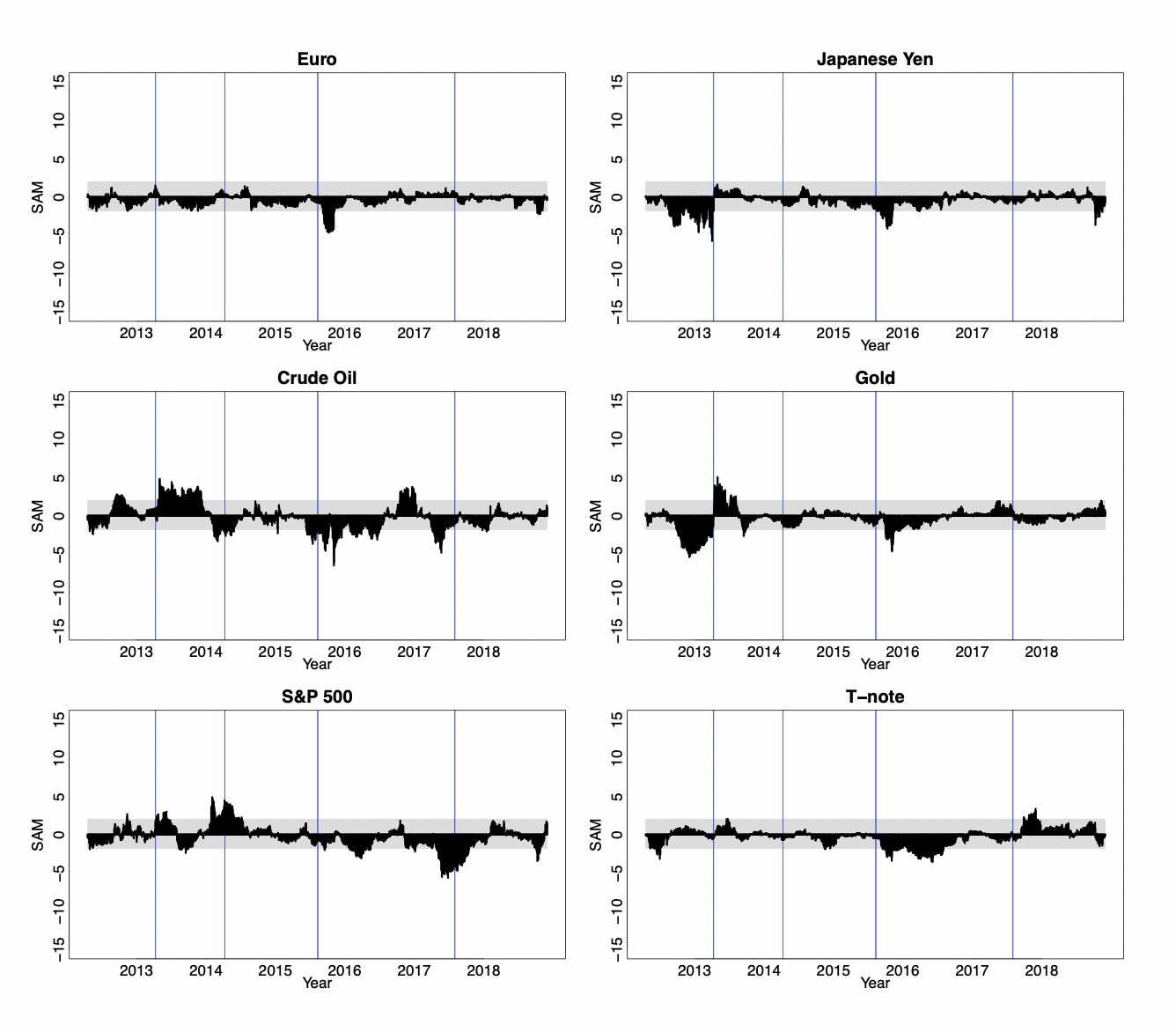

08/2023: · 6th International Conference on Econometrics and Statistics (Ecosta), Tokyo · “Distributional asymmetries and currency returns.”

-

07/2023: · International Financial and Banking Society (IFABS), Oxford · “Distributional asymmetries and currency returns.”

-

06/2022: · 6th International Workshop on Financial Markets and Nonlinear Dynamics (FMND), Paris · “Persistence of the higher moments risks.”

-

10/2021: · Statistics of Machine Learning (Stat of ML), Prague · “Distributional asymmetries and currency risk.”

-

08/2020: · Statistics of Machine Learning (Stat of ML), Prague · “Horizon-specific risk, higher moments, and asset prices.”

-

12/2018: · 12th International Conference on Computational and Financial Econometrics (CFE), Pisa · “Horizon-specific risk, higher moments, and asset prices.”

-

08/2018: · 2nd International Conference on Econometrics and Statistics, Hong Kong · “Does Skewness and Kurtosis Predict Asset Returns in the Long Run?”

-

04/2018: · Fifth International Symposium in Computational Economics and Finance, Paris · “Does Skewness and Kurtosis Predict Asset Returns in the Long Run?”

-

12/2017: · 11th International Conference on Computational and Financial Econometrics (CFE), London · “Do Cryptocurrencies and Traditional Asset Classes Influence Each Other?”

Teaching

Courses

- Lecturer (at IES FSV UK)

- Data Processing in Python (JEM207) · 2025-present

- Teaching Assistant (at IES FSV UK)

- Statistics (JEB106) · 2025-present

- Financial Econometrics I (JEM059) · 2018-present

- Teaching Assistant (previously at IES FSV UK)

- Advanced Econometrics (JEM005)·2017-2021

- Quantitative Methods II · 2019

- Advanced Financial Econometrics II · 2020

Services

Thesis supervision

- Ongoing: 1 bachelor, 3 master

- Defended: 4 bachelor

Refereeing

-

International Review of Financial Analysis

-

Financial Innovation

-

Financial Markets and Portfolio Management

-

North American Journal of Economics and Finance

-

Journal of Multinational Financial Management

-

Czech Journal of Economics and Finance

Powered by Jekyll and Minimal Light theme.

IRFA

IRFA

FRL

FRL